DC pensions climate friendly investment up 23 percent

As demand for sustainable investing grows among UK consumers, new analysis from independent consultancy Barnett Waddingham reveals that defined contribution pension (DC) schemes have achieved notable progress towards Net Zero in recent years, as they strive to meet member demands and targets.

According to the analysis, which reviews the asset allocation and sustainability ambitions of 22 default DC pension strategies at the UK’s leading workplace providers, as of 31st December 2023, 86% of these schemes have now set targets to reach Net Zero by 2050, with 18% of these targeting 2040.

The research, which has been conducted annually by Barnett Waddingham since 2021, finds that 15 investment solutions offered by leading pension schemes have targets in place to reach Net Zero by 2050, four have targets to reach it by 2040, and just three have no Net Zero targets currently.

Of the schemes which have set Net Zero targets, encouragingly, all but one (81%) of these have committed to achieving interim targets, which in many cases see the scheme aiming to achieve a 50% emissions reduction by 2030.

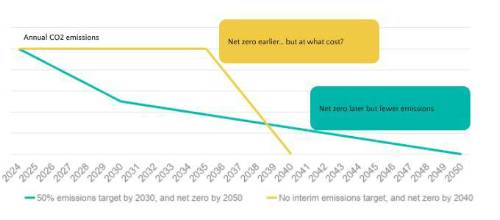

Interim Net Zero targets can have a more substantial impact on net emissions than an earlier end goal. For example, if a scheme aims to achieve Net Zero by 2050, but sets interim targets for 2030, this could see a net reduction of emissions by 30% over the next 26 years compared to a scheme working to achieve Net Zero by 2040 with no interim targets.

For the most part, these providers are using index-tracking funds to incorporate sustainability. Barnett Waddingham views this as an appropriate way to tackle climate transition risks, but in the new research reveals some more innovative strategies being employed by providers, including:

• Investing in green bonds (debt securities issued by companies to finance projects that contribute to the environmental and energy transition)

• Investing in impact equities with specific biodiversity targets linked to the Sustainable Development Goals

• Working to access opportunities that address both societal and environmental needs. This has been primarily through renewable infrastructure, but also real estate, private equity and natural capital.

Of the three schemes that have not set formal, long-term Net Zero targets, two have set no targets at all. The other has stated it is prioritising immediate action rather than long-term targets, instead focussing on significantly reducing its portfolio’s carbon footprint by over 60% compared to the market.

Since Barnett Waddingham’s initial sustainability analysis of the pension scheme market in 2021, it has observed a 23% increase in schemes’ investment in assets with climate targets during the growth phase. However, when looking at the ‘At Retirement’ phase – as members approach retirement and are moved into lower risk investment strategies – many schemes are yet to take action. This is because most sustainability strategies focus on equities markets rather than fixed income markets – in fact, on average only 20% fixed income assets have built in emissions targets, excluding government bonds.

This is especially concerning given bonds serve as a significant but often overlooked source of climate risk – corporate bonds alone contribute up to 50 per cent of fossil fuel financing. By neglecting to address bond investments, DC pension schemes could be leaving themselves vulnerable to potential legal risks further down the line. With fixed income markets having evolved significantly in recent years, schemes should consider building on their progress to date and addressing sustainability for assets other than equity to ensure better outcomes for members.

Sonia Kataora, Partner and Head of DC Investment, Barnett Waddingham, said: “With demand for sustainable investment showing no signs of slowing, it’s encouraging to see that schemes are listening and driving positive outcomes for members. Reaching the ‘holy grail’ of Net Zero will by no means be an easy feat for schemes, so the fact that the vast majority have committed to this target – but also set interim goals – are certainly signs that we are moving in the right direction.

“But there are different shades of green. While we’ve seen that most schemes tend to offer some level of climate-aware investing, others do not have interim targets, or leave fixed income out of their sustainability strategy altogether. This risks some members having greener schemes than others, possibly without their knowledge or choice. The world has evolved, and the market is well placed to be much more innovative in its approach to sustainability.

“To move forwards, we need to see three key actions across the market. Firstly, all providers must contribute to the industry push for transparency, and offer in-depth reporting on their sustainability strategies. Secondly, they must be able to articulate which specific sustainability-related risks and opportunities they are trying to manage using the different building blocks in their portfolio – not just equities, but also how comfortable they are pursuing sustainable strategies as part of their toolkit in achieving a good financial return for members. And lastly, effective stewardship must be joined-up across voting and engagement activities to maximise benefit. Only with this articulation and transparency, can we be sure that members understand how sustainability impacts their savings.”